Understand what a SWIFT code is, how it works in international transactions, and how to find the correct code for global money transfers.

SWIFT: Your Complete Guide to International Money Transfers

Ever wondered why a transfer to your cousin Ana in Barcelona clears in hours rather than days? Or puzzled over those random letters and digits that appear when sending money abroad? Whatever brought you here, the guesswork ends today.

Maybe your monthly support goes to parents in Manila, vacation deposits land at a Caribbean resort, or you simply want to understand how transfers cross oceans without losing dollars. In each case, the mechanics and the suspense of waiting vanish once you understand SWIFT basics. No confusing acronyms, just practical facts that let you hit “Send” with confidence.

What Exactly Is SWIFT?

Imagine WhatsApp, but built for bankers, with military-grade encryption, and handling trillions of dollars before breakfast. The full name—Society for Worldwide Interbank Financial Telecommunication—sounds impressive, but it isn’t what matters when your rent deadline looms.

Here’s the key takeaway: SWIFT doesn’t carry money itself. It sends bulletproof messages directing one bank to tell another where to find the funds. That distinction saves headaches.

Think of organizing a surprise party across three continents using only smoke signals. That chaotic relay of half-heard messages is how international banking worked before SWIFT launched in 1973. Today, the system handles over 42 million messages daily, connecting more than 11,000 banks across 200+ countries.

SWIFT network explained: Why This Matters to You

When you wire $50 to a college friend or send $5,000 home for a family medical bill, that money travels on SWIFT’s electronic backbone. Understanding how it works helps you:

- Calculate transfer fees that actually make sense

- Avoid rookie mistakes that delay payments

- Find the fastest route for your money

- Include the right details so transactions clear smoothly

SWIFT vs BIC: SWIFT Codes: Your Bank’s Global Address

SWIFT payment system: Every branch handling international payments needs an address, or funds drift into cyberspace. That unique identifier is the bank’s SWIFT code (also called a BIC code; the terms are interchangeable).

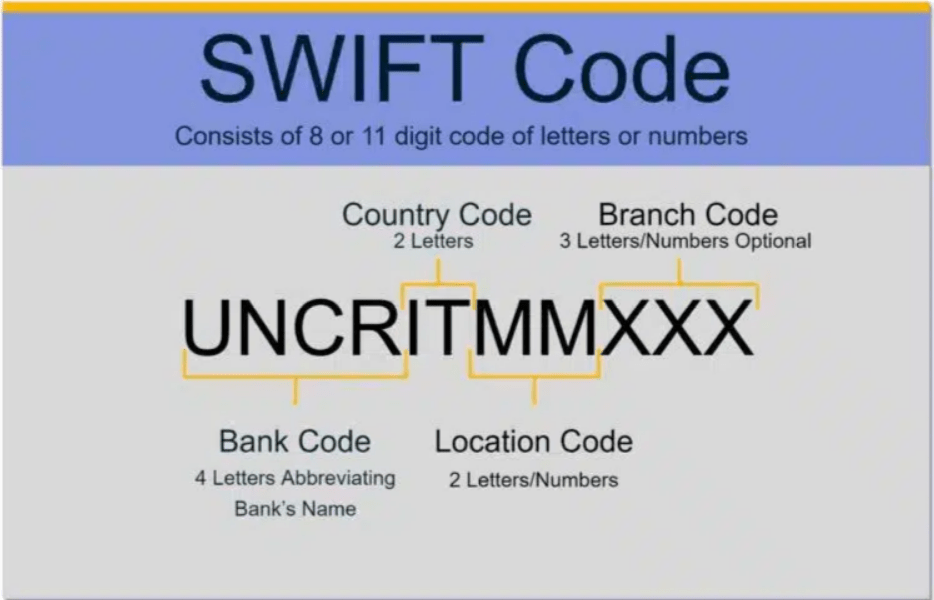

SWIFT code format: Deciphering a SWIFT Code

A SWIFT code compresses an entire financial institution into 8 to 11 characters:

- First 4 letters: Bank name (CHAS = Chase)

- Next 2 letters: Country code (US = United States)

- Next 2 digits: City code (33 = New York)

- Last 3 characters: Often XXX, indicating the main branch

Example: CHASUS33XXX = Chase Bank’s main New York office

SWIFT code example: Popular SWIFT Codes by Bank

| Institution | Country | SWIFT Code | Primary City |

|---|---|---|---|

| Chase | United States | CHASUS33 | New York |

| Bank of America | United States | BOFAUS3N | New York |

| Wells Fargo | United States | WFBIUS6S | San Francisco |

| Barclays | United Kingdom | BARCGB22 | London |

| HSBC | Hong Kong | HSBCHKHH | Hong Kong |

How to find SWIFT code: Finding a SWIFT Code: Five Real-World Tips

- Check the bank’s website – Look for “International Transfer” or “Wire Transfer” sections

- Log in to online banking – Information often appears under wire transfer requests

- Call customer service – Representatives provide codes within minutes

- Review bank statements – Many institutions print codes near transaction records

- Use the mobile app – Fairexpay’s International money transfer menus typically display codes.

Important: Verify the code before submitting. One wrong character can reroute funds to the wrong destination, causing delays and fees.

How SWIFT works: How Your Money Actually Travels

Picture this: You’re sending $1,000 to your cousin learning the ropes in London. Here’s the journey your money takes:

Step 1: You Start the Journey

Whether at a branch or on your phone, you provide essentials: full name, address, UK account number, SWIFT code, and the amount.

Step 2: Your Bank Creates the Message

A simple “Give John $1,000” won’t work. Behind the scenes, a template called MT103 gets filled out with precise details in universal banking language.

Step 3: The Message Travels

Your instruction faces its first decision point. If your bank has a direct connection with your cousin’s bank, the message travels straight through almost instantly. Otherwise, it might bounce through one or two intermediary banks, each adding a small processing fee.

Step 4: The Money Moves

While routing happens, actual funds glide through correspondent accounts. Most large banks keep British pounds in London clearing accounts, so your cousin gets credited the moment the notification arrives—no physical cash crosses the Atlantic.

Step 5: Your Cousin Gets Paid

Once the UK bank receives the signal, it verifies the identifiers and credits your cousin’s account. Barring holidays or backlogs, the entire process, from your keystroke to final credit, typically takes one to five business days.

SWIFT in international transfers: Why International Transfers Cost So Much (And How to Pay Less)

Anyone who’s wired money overseas knows the shock when a $100 transfer becomes $70. That $30+ gap isn’t bad luck—it’s a well-oiled machine of charges.

Where Your Money Goes

Processing fees: Your bank charges $15-45 regardless of the amount.

Intermediary fees: Each middle bank clips $10-25 for bookkeeping.

Exchange rate markup: Banks inflate rates by 2-4% above market rates.

Receiving fees: Destination banks often charge $10-20 entry fees

Smart Ways to Save Money

Look at total cost: Fee plus exchange rate spread, not just headline fees

Time it right: Wait for stronger rates if you’re flexible on timing

Use modern platforms: Wise, Remitly, or Western Union often beat big banks

Check loyalty programs: Frequent senders get discounts on many platforms

Bundle payments: Combining transfers can reduce per-transaction costs

SWIFT vs. Modern Alternatives

Traditional Bank Wire via SWIFT

- Best for: Large transfers (six figures), maximum compliance

- Speed: 1-5 business days, sometimes longer

- Cost: High fixed fees

- Convenience: Multiple security steps, documentation required

Modern Transfer Platforms (Wise, Remitly, etc.)

- Best for: Regular transfers, tuition payments, payroll

- Speed: Minutes to hours

- Cost: Better exchange rates, lower fees

- Convenience: Mobile-friendly, minimal paperwork

Cash Operators (Western Union, MoneyGram)

- Best for: Recipients without bank accounts, remote locations

- Speed: Nearly instant pickup

- Cost: Percentage-based fees can be expensive

- Convenience: Available at corner shops, pharmacies, and bus terminals

Avoiding Common Pitfalls

Mistake 1: Wrong SWIFT Code

Consequence: Money goes to the wrong bank. Fix: Double-check the code with both sending and receiving banks.

Mistake 2: Incomplete Recipient Information

Consequence: Delays, returned transfers, extra fees. Fix: Verify names, account numbers, and addresses before submitting.

Mistake 3: Ignoring Cut-Off Times

Consequence: Next-day processing instead of same-day. Fix: Know daily deadlines (often 2-5 PM local time)

Mistake 4: Overlooking Holidays

Consequence: Unexpected delays. Fix: Check holidays in both the sender and the recipient countries.

Mistake 5: Not Comparing Total Costs

Consequence: Paying more than necessary. Fix: Add all fees plus exchange rate markup for the true cost.

SWIFT code vs IBAN: When Things Go Wrong

Delayed Transfers

Contact your bank for tracking details and reference numbers. Most delays stem from compliance reviews and resolve within 24-48 hours.

Money Sent to Wrong Account

Report immediately. Banks are obligated to investigate. Keep all confirmation emails and reference numbers.

Unexpected Fees

Review your original agreement. Request detailed fee breakdowns—you have the right to understand all charges.

The Future of International Transfer

Expect faster, cheaper options ahead:

- Central bank digital currencies promising near-instant, low-cost transfers

- AI optimization of transfer routes and fraud detection

- Open banking rules are increasing competition and lowering fees

Your Action Plan

Before Your Next Transfer

- Shop around – Compare banks, online platforms, and money transfer services

- Gather information – Get the recipient’s full name, account number, and SWIFT/bank code

- Calculate total cost – Add fees, percentages, and exchange rate markup

- Check timing – Note cut-off times and holidays

- Save documentation – Keep screenshots and email confirmations

Questions to Ask Your Bank

- What’s the all-in cost, including exchange rate spreads?

- How many business days should I expect?

- What’s your daily cut-off time for same-day processing?

- Will I get live tracking updates?

- What recipient information do I need?

Conclusion: You’re Now a SWIFT Expert

With this knowledge, overseas transfers become straightforward errands. You’ll be able to:

- Match transfer methods to your needs and budget

- Avoid unexpected fees and delays

- Send money with the confidence of an insider

Next time you need to move money globally, you’ll know exactly what to expect—and how to get the best deal.

Frequently Asked Questions

Do I always need a SWIFT code?

Yes, for bank-to-bank transfers. Some platforms hide this complexity by auto-filling codes when you enter bank names and locations.

Why does my transfer take so long?

Usually, compliance reviews are not the actual wire transfer. Every transaction must pass anti-money-laundering and counter-terrorism finance checks.

Is my money safe during transfer?

Absolutely. SWIFT uses military-grade encryption, and banks carry insurance until funds arrive. Time delays are common; theft is not.

Can I cancel after sending?

Maybe, but only within minutes. Once money reaches the recipient’s bank, you typically need their cooperation to reverse it.

Should I use my bank or a transfer service?

For transfers under $10,000, independent services often cost less due to better exchange rates. Larger amounts may warrant traditional banks for maximum oversight and security.

The key factors: amount, urgency, destination, and how much you value peace of mind. With this checklist, you’re ahead of most first-time senders.

Leave a comment